Estate Planning

Protect your legacy and your family

Estate planning is an integral part of your financial strategy. You've spent a lifetime creating a legacy to pass onto those you care about. None of us look forward to thinking about loss of life, being unable to make decisions for ourselves or care for those we love. This is a topic so many families put off, causing them to be caught off-guard and unprepared, especially when unplanned incapacity or loss of life does happen.

Don't wait to start planning. We have the experience and resources to help simplify what can often be a complex and emotional decision. Working with you and your attorney, we'll help develop the legacy you want to leave and an implementation strategy that will carry out your wishes.

We work with your estate planningD attorney to identify the best ways to:

- Manage assets if you're disabled

- Manage investments for family after your passing

- Help reduce or avoid estate taxes

- Support an elderly relative

- Support a special needs individual

- Provide for a child's education

- Make charitable bequests

- Protect your privacy

Our team can also assist your family with:

- Estate settlement services

- Application of federal and state tax lawsD

- Accounting principles

- Investment management

Create an estate plan and preserve your future today

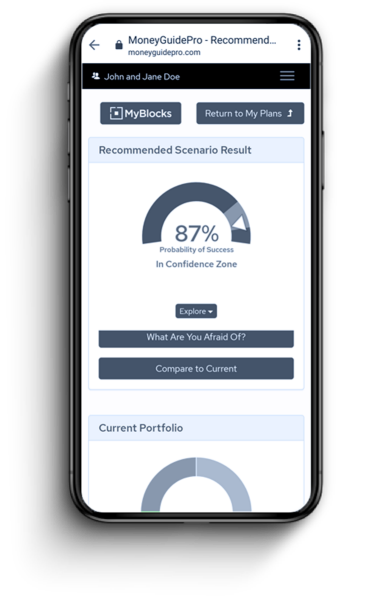

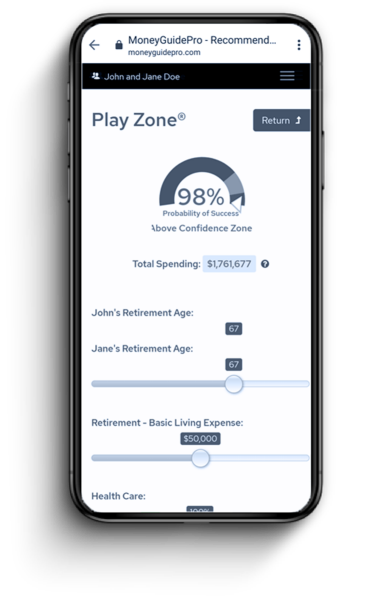

View your financial plan at a glance

Adjust goals to see different scenario outcomes

Collaborate with your financial partner