Education Funding

One of the most important investments you can make

The cost of college continues to rise, outpacing the rate of inflation year after year. Our college planning services prepare you for the added expense of one of life's most important investments.

It's never too early to start planning for a child or grandchild's education. In fact, the earlier the better. If you're like most families, life is busy and the thought of researching the complexities of the college-planning process can be overwhelming. There's a lot to consider:

- How much time do I have to save?

- How many children do I need to save for?

- Does each child need a savings plan, or is it transferable?

- How much will college cost?

- Are there any tax advantagesD to different savings options?

- What happens to college funds if my child chooses not to attend college?

We can help you understand the different college savings options available from traditional 529, Coverdell and Custodial college savings plans to customized investment portfolios. We'll help you find ways to reduce out-of-pocket college expenses that also fits within your overall financial strategy and college savings timeline.

Start saving for education today

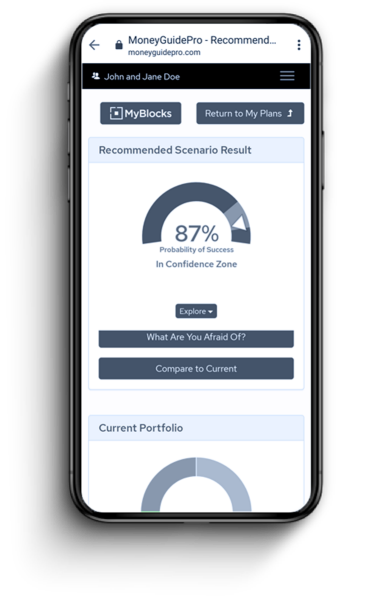

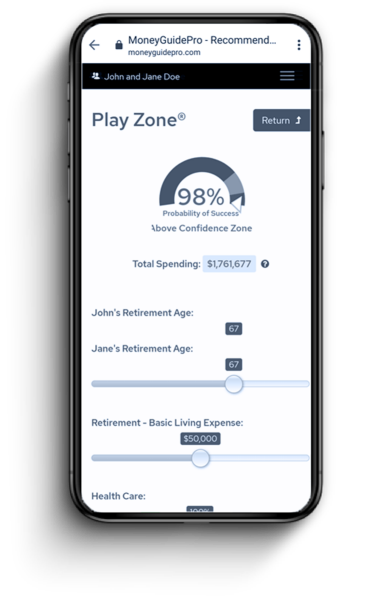

View your financial plan at a glance

Adjust goals to see different scenario outcomes

Collaborate with your financial partner