Investment Management

Invest on your terms

When it comes to investing, we understand it’s complex. What works for you may not work for anyone else. While considering your investment portfolio, you may have the following questions:

- Will my portfolio continue to perform in the future?

- Do I have too many eggs in one basket?

- Do I have a full picture of all of my assets?

- Has my portfolio been performing the way I want it to?

- What do I want to achieve with my investments?

- At what point will I need access to those investments?

We can help answer these questions and then manage the complexities with data-backed recommendations. We’ll pull together your full financial picture, analyze past market and portfolio performance and provide you with industry news to help guide future investment decisions. With the right information, you can find a balance between risk and return that works for you and stay on track.

However you like to manage your investments, we have the resources to help you be smarter with money—whether you prefer self-directed access, or would like full-service investment planning services.

Through the combined efforts of our Investment Advisory Services and Ally Private Wealth Investor Services (a broker/dealer and Registered Investment Advisor) teams you get the advice and assistance of experienced investment specialists.

Choose from a comprehensive range of accounts and services to optimize your investment portfolio:

- Brokerage and investments products

- Asset Management Account

- Insurance

- Retirement Accounts

- Educational and custodial accounts

Consult with our team of experienced professionals

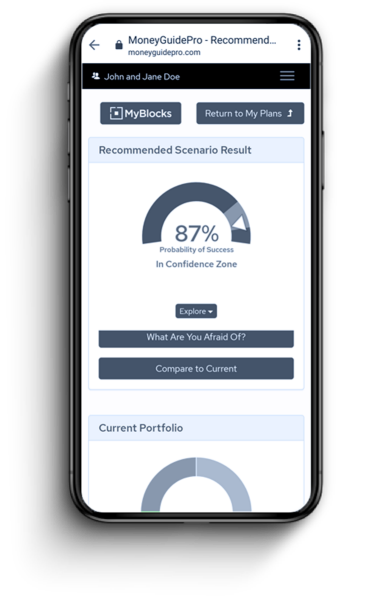

View your financial plan at a glance

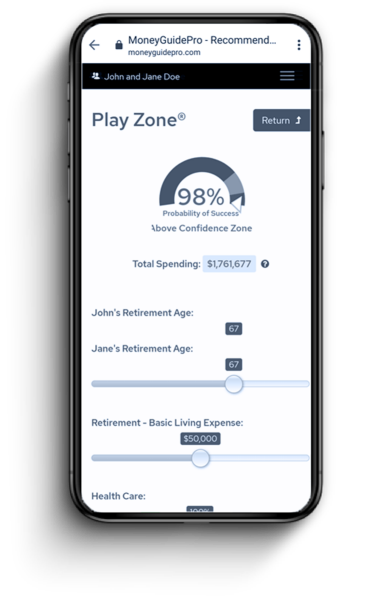

Adjust goals to see different scenario outcomes

Collaborate with your financial partner