Business Investment Sweep

Get the most from every dollar

Lower Costs

Minimize your investment costs.

Earn More

Increase investment income by earning interest on all eligible funds—every night.

Save Time

Eliminate the manual transfer of funds between accounts with automatic daily investments.

Maximize your interest income

Earn interest

Earn competitive interest rates, preserve asset liquidity and minimize capital risk with a variety of investment options.

Ongoing investments

Collected funds are continuously invested using your standard business checking account.

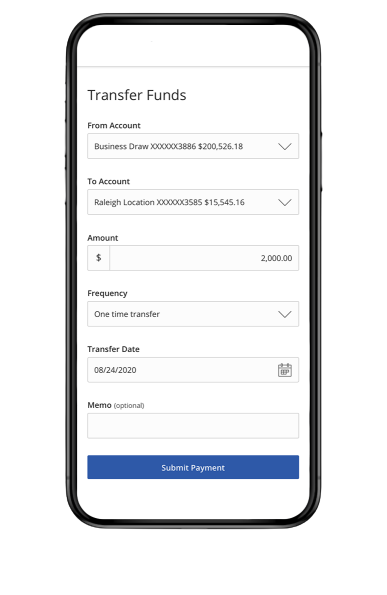

Target your balance

Maintain a targeted balance in your checking accounts and transfer funds easily.

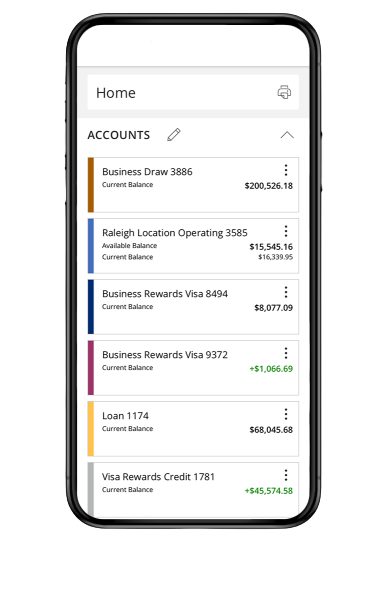

Manage your business on the go

Manage your accounts from anywhere

Send and transfer money using ACH and wires

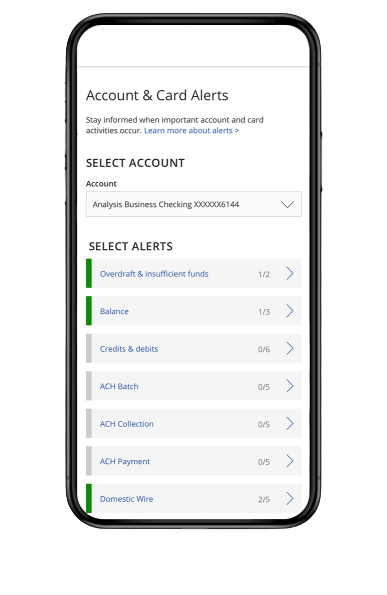

Receive account and security alerts