Check Positive Pay (Positive Pay)

Protect your business from check fraud

Upload

Submit an electronic file each time you issue checks.

Personalize

Payee Positive Pay is an optional service that adds a payee's name onto the check.

Approve

Exceptions are presented to you for approval.

Advanced protection

Check Positive Pay examines each check and reports any irregularities found, directly to you. This service is available within Digital Banking and Commercial Advantage.

Identify

Check Positive Pay matches the check number, dollar amount and account number against an electronic file provided by your business that contains a list of issued checks.

Compare

We compare every check presented for payment against the cumulative electronic file.

Review

Checks that don't match this list are presented within Digital Banking and Commercial Advantage for review. You determine whether they should be paid or returned.

See the difference

Compare the differences between Check Positive Pay and Reverse Positive Pay.

Check Positive Pay |

Reverse Positive Pay |

|

|---|---|---|

Check Activity |

Moderate to high activity |

Low check activity |

Electronic File |

Send a list of your daily check run |

We send a list of checks presented for payment |

Check Matching |

We match presented checks against a history-to-date list of issued checks |

You match presented checks against a history-to-date list of issued checks |

Exceptions Notification |

Email notifications sent |

Email notifications sent |

Customer Check Approval |

We review checks presented and paid by bank. You decide to pay or return by 3:30 pm ET |

You review checks presented, paid by bank and decide to pay or return by 3:30 pm ET |

Fraud detection of physical checks (presented at branch) |

Service available |

N/A |

Payee Positive Pay |

Service available |

N/A |

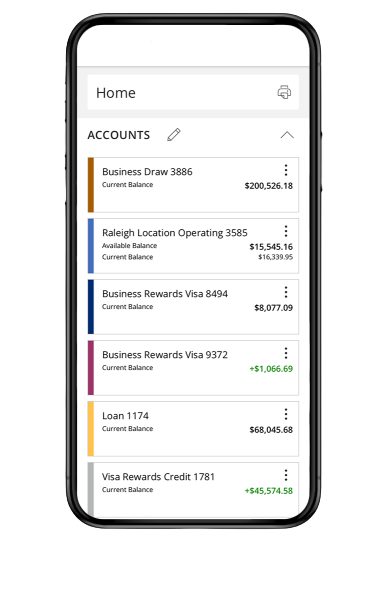

Manage your business on the go

Manage your accounts from anywhere

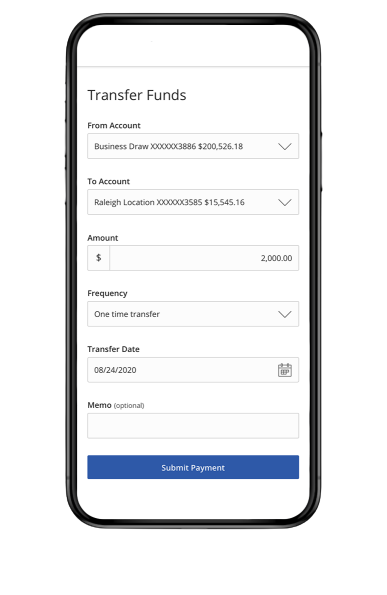

Send and transfer money using ACH and wires

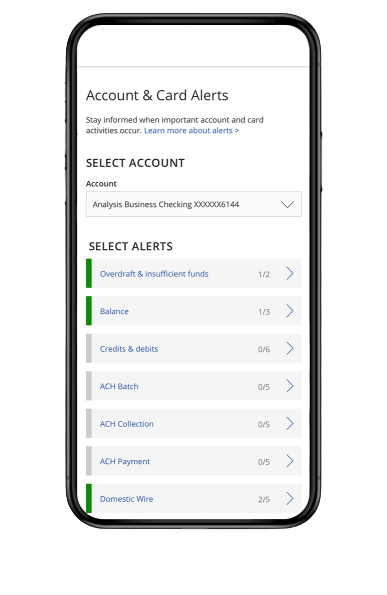

Receive account and security alerts