Every year, billions of dollars are lost to check and electronic fraud. It's one of the largest fraud challenges facing businesses today.

It can happen as easily as someone stealing a blank check, an employee issuing a check without proper authorization, counterfeiting, or intentional or mistaken duplicate deposits.

With the popularity of mobile banking products, the chance of a check being deposited twice has increased. While Ally Private Wealth will always help protect your account, we offer a proactive approach that puts you in control and able to fight fraud with a few clicks of a button.

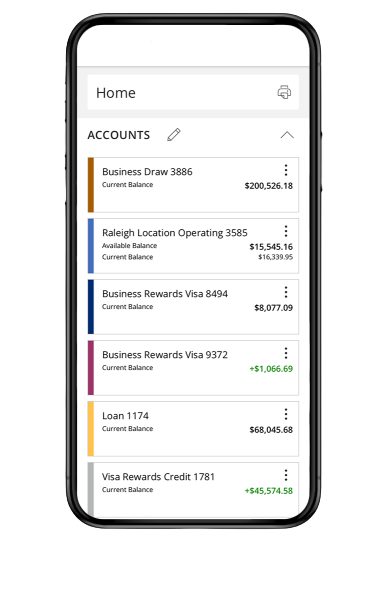

Ally Private Wealth's Positive Pay check-monitoring service can help you detect and stop check fraud from negatively impacting your business. We offer several options of protection to fit your business's needs. And with Digital Banking for business, you have the freedom to manage decisions on your mobile device.

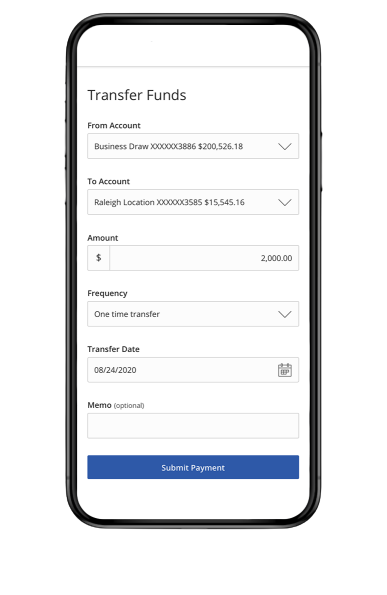

With standard Positive Pay, each time you issue checks, you will send an electronic file with the check number, amount and date to Ally Private Wealth using your online banking portal. The Payee Match option can provide an additional layer of security by matching the payee name on the check as well.

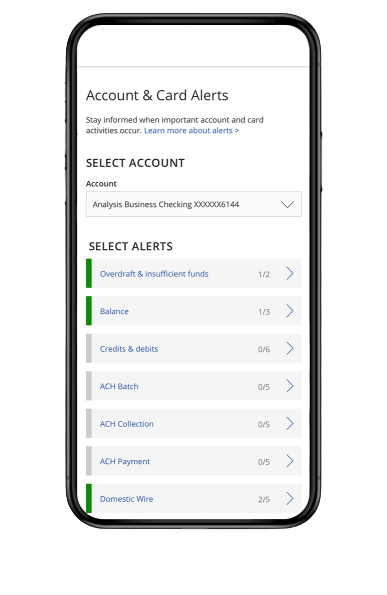

As checks clear your account, you will receive a text or email alert to notify you if any irregularities are found. The service will present the check the next day for you to make a pay-or-return decision.

If a decision is not made prior to the cutoff time, the check will follow your previously selected default option: Pay or Return.

Reverse Positive Pay allows you to monitor each cleared check for alterations—or even fraudulently cleared items—and return any unauthorized items.

This option is ideal for lower check volume accounts or clients who don't wish to submit an electronic check issue file.

When a check is presented to your account, all users who have permissions within Digital Banking will receive an alert and have until the current cutoff time to decision items. If no decision is made, the item will pay as presented.

Positive Pay also includes comprehensive reporting capabilities that allow you to review your decisions history and Positive Pay activity for the past 65 days.

Safeguard against fraud, and help proactively protect your accounts with Ally Private Wealth Positive Pay.

To learn more, please visit onlineapw.com or contact your local Ally Private Wealther today.