Property Insurance

Simple, affordable property insurance

Homeowners

Protect your most important possessions with a simple, affordable policy.

Condo

Get low-maintenance coverage for the inside of your unit.

Renters

Cover what matters to you, even if you don't own your home.

Collectibles

Get extra protection for your most cherished items.

Flood

Make sure a few inches of water doesn't cost you thousands of dollars.

Get 24/7 insurance access from any device

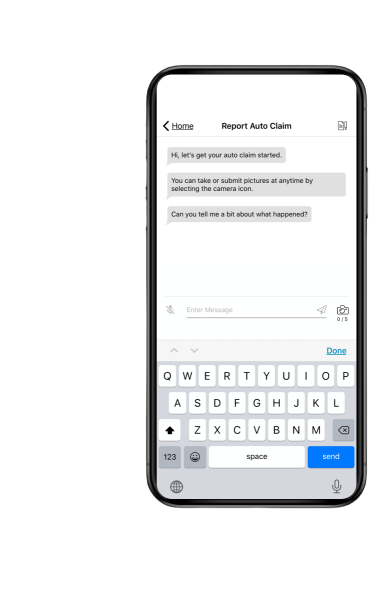

File a claim and upload photos

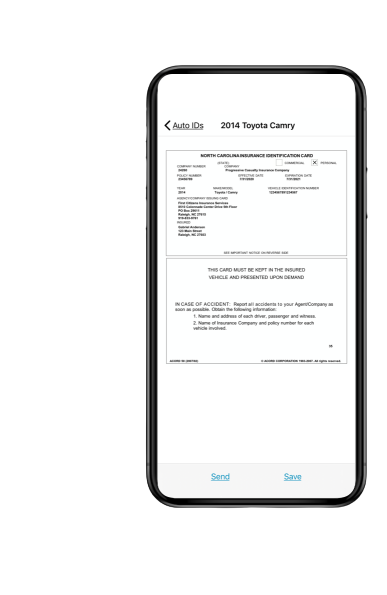

Access your auto ID cards

Update driver and vehicle status