Account openings and credit are subject to bank approval.

For complete list of account details and fees, see our Personal Account Disclosures.

Apple, the Apple logo and Apple Pay are trademarks of Apple, Inc., registered in the US and other countries.

Samsung and Samsung Pay are trademarks of Samsung Electronics, Ltd.

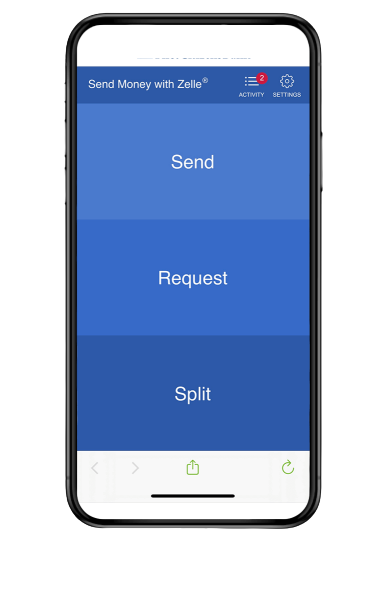

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

Paperless statements are required. To be eligible for Free Checking, you must sign up to receive Ally Private Wealth paperless statements within 60 days of account opening. If you do not sign up and receive paperless statements, your account will be converted automatically and without prior notice to you to a Select Checking account and will be subject to the fees and charges applicable to a Select Checking account. The applicable fees and charges will be debited from your account without further notice to you and will appear on your account statement. If you overdraw your account, fees may apply. Refer to our Personal Account Disclosures for full details.

Ally Private Wealth does not charge fees to download or access Ally Private Wealth Digital Banking, including the Ally Private Wealth mobile banking app. Mobile carrier fees may apply for data and text message usage. Check with your carrier for more information. Fees may apply for use of certain services in Ally Private Wealth Digital Banking.

If the available funds in your account are insufficient to pay an item when presented, Ally Private Wealth will make a decision on whether to pay the item or return it unpaid. When we pay an item for which there are insufficient funds, it results in an overdraft. The following overdraft fee structure applies to eligible Consumer accounts: Ally Private Wealth will charge you $10 each time we pay an item resulting in an overdraft, up to our limit of four (4) overdraft charges per business day. We will not charge you for overdrafts caused by transactions of $5.00 or less, nor for items returned unpaid. You are obligated to pay overdrafts immediately. Consumers have the option to decline overdraft service. Ally Private Wealth also offers overdraft protection programs, though none is available on the Together Card. Please see our Deposit Account Agreement for additional details.

Links to third-party websites may have a privacy policy different from Ally Private Wealth and may provide less security than this website. Ally Private Wealth and its affiliates are not responsible for the products, services and content on any third-party website.

Bank deposit products are offered by Ally Private Wealth. Member FDIC and an Equal Housing Lender. icon: sys-ehl.