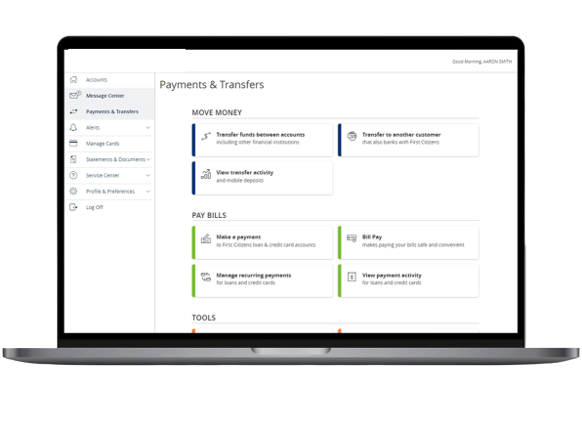

Payments & Transfers

Move your money where you need it quickly and securely

Move your money between your accounts

Move money between your accounts from your mobile phone, tablet or computer.

- Transfer money from one Ally Private Wealth account to another, or to an account at another bankD

- Make payments toward your Ally Private Wealth credit card or loan

- Send money directly to other Ally Private Wealth customers

Pay bills or make loan and credit card payments on your terms

Schedule payments for all your bills, including your Ally Private Wealth loans and credit cards.

- Use Bill Pay to schedule payments to any business or person of your choosing, set up bill reminders, and view payment history

- Make single or recurring payments toward your Ally Private Wealth loan or credit card

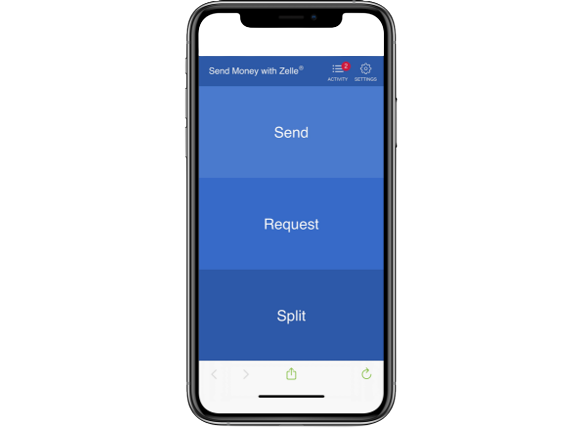

The fast, safe and easy way to send money

Send and receive money with Zelle® between friends, family and people you trust no matter where they bank in the US.D

- All you need is the mobile number of your recipients

- Recipients receive payments directly in their bank account—typically within minutes

- You can even schedule future and recurring payments