Simple IRA

Give employees motivation to save

A small business Savings Incentive Match Plan for Employees Individual Retirement Account, or SIMPLE IRA, is a contribution-based retirement investment account designed specifically for small businesses with 100 or fewer employees.

Easy Set Up

Simple to set up and easy to maintain.

Pre-Tax Advantage

Make tax-deferred contributions through payroll deductions.

Flexible

Choose between options to customize employer contributions.

Keep retirement plans simple

A SIMPLE IRA is best for businesses under 100 employees or self-employed individuals.

Easy and affordable

Match or set?

Employer contributions are based off a match or a set percentage.

Smart deductions

Employee contributions are pre-tax and made through payroll deduction.

More options

A variety of investment options are available, including CDs, mutual funds, stocks, bonds, annuities, Exchange Traded Funds (ETFs) and managed asset accounts.

Make the most of your plan

Flexible

Adjust your employer contribution to pay a 2% fixed percentage or a match up to 3%.

Contribute more

Reduce business taxes with additional tax deductions and credits that may be available.

Easy to maintain

Save time and money with less paperwork and administration.

Not sure where to start? We'll help you find the path to a successful retirement today

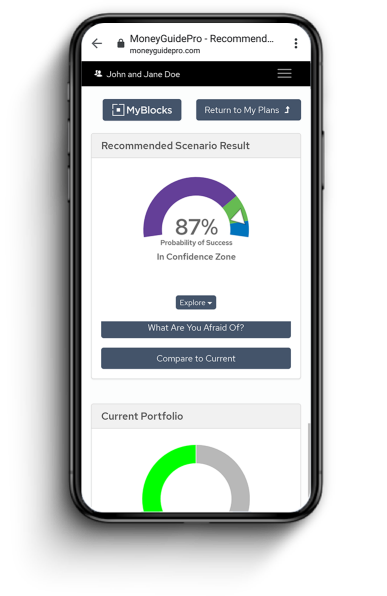

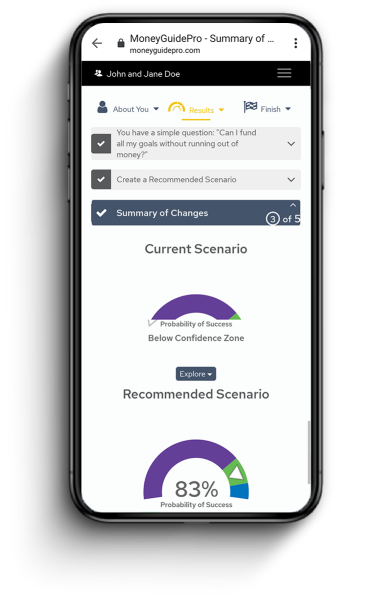

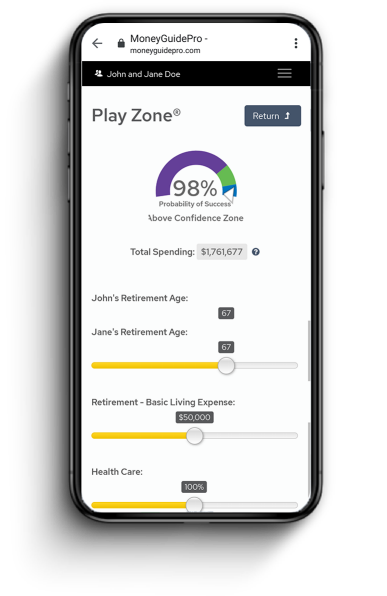

View your financial plan at a glance

Adjust goals to see different scenario outcomes

Collaborate with your financial partner