Business Account Management

Better business banking online

Know where your money goes with Digital Banking for business

Data at your fingertips

Quickly access account information from your computer, phone or tablet. Manage all of your business's accounts in one place and quickly see if a check has cleared, which deposits are pending, how much credit is available and much more.

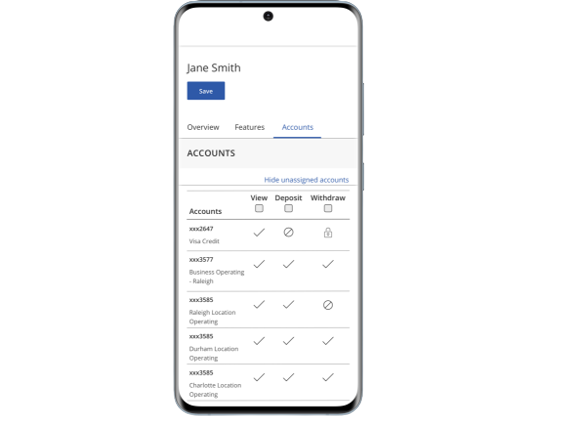

Customize user access

Give employees, accountants, bookkeepers and others quick access to what they need with custom user permissions. Set daily spending limits and approval workflow so you can delegate tasks and keep control of your finances.

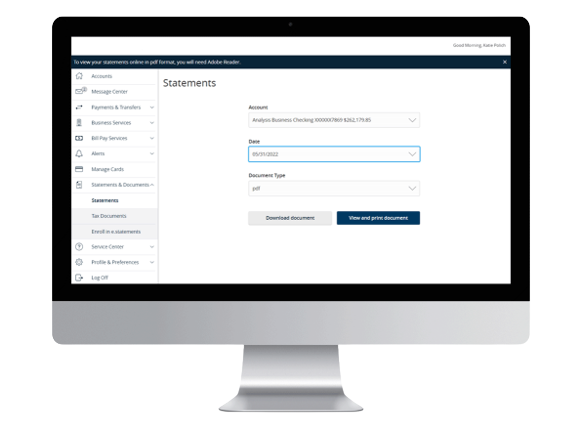

Access your statements and tax documents

Get tax forms to send to your accountant or a statement to reconcile business books quickly and conveniently.

Bank with confidence

Alerts and notifications allow you to spend more time focused on your business while we focus on keeping your money safe. Online card account management tools help you handle potential issues quickly without a call.