Analysis Business Checking

Designed for businesses with high activity levels

Low Monthly Fee

Monthly fees offset by account balances.

Flexibility

Manage a variety of cash flow options and optimize earnings.

Bank When You Want

Access to Commercial Advantage, including online statements and Bill Pay.

One relationship

For companies with several related accounts and more complex financial needs, this analysis business checking account puts your money to work for you, through a competitive monthly Earnings Credit Rate.

Convenience without costs

Open with less

Put your money to work today with a $100 minimum opening deposit in a non-bearing interest account.

Pay with confidence

Your Visa® Business Debit Card offers a safe, convenient way to pay for purchases, manage cash flow and increase efficiency—all for free.

Improve cash flow

Understand the basics of cash flow, and learn how to manage and improve it with our Treasury Services.

What is Earnings Credit Rate?

Earnings Credit Rate, or ECR, is the interest rate a bank pays on customer deposits. Rather than being applied to the deposit directly, ECRs are used to reduce the fees customers pay for other banking services. Because depositors leave balances in non-interest bearing accounts, the bank will apply an ECR on those balances and use that as a credit for services.

ECR is often correlated with the US Treasury bill, or T-bill, rate.

Manage your business on the go

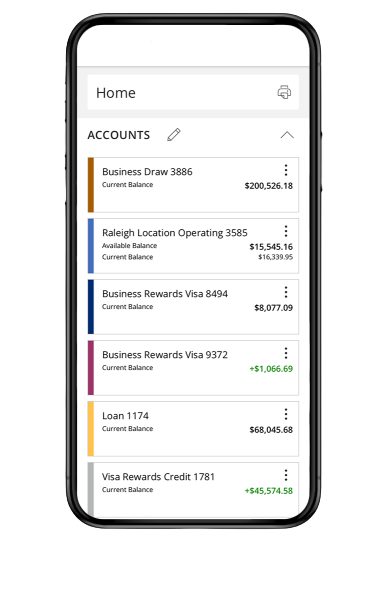

Manage your accounts from anywhere

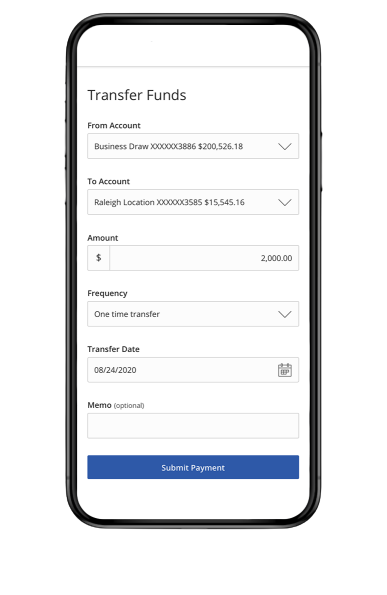

Send and transfer money using ACH and wires

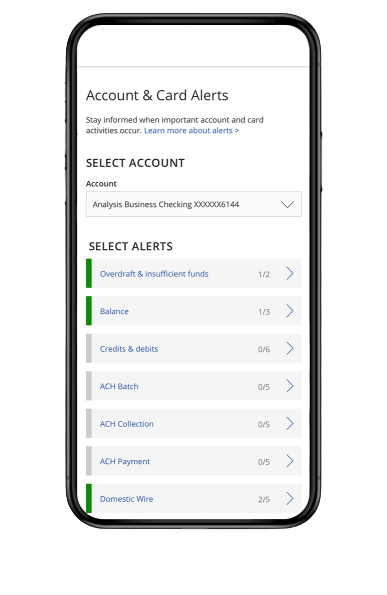

Receive account and security alerts