Standby Letters of Credit

A flexible tool for a variety of situations

When you encounter a business transaction that requires assurance that your payment will be made—but a trade or documentary letter of credit does not fit—a standby letter of credit, or SBLC, may be what you need. A standby letter of credit doesn't have to be related to the purchase of goods or services. It's based on a contractual agreement or other obligation and is drawn upon by the beneficiary only when the applicant fails to meet the underlying obligation.

Advantages of Standby Letters of Credit

Certify

Certify creditworthiness in domestic as well as foreign transactions.

Simplify

Eliminate the need for cash deposits or more complicated guarantees, such as bid or performance bonds.

Validate

Establish creditworthiness of US-based parent companies to subsidiaries overseas.

Save

Reduce banking costs, since SBLCs are less expensive than bonding and other credit facilities.

Guarantee

Ensure that international transactions are properly structured.

Letter of credit forms

Application Agreement

Standby Letter of Credit Application (PDF)

Application Instructions

Standby Letter of Credit Application Instructions (PDF)

Amendment Request

Letter of Credit Amendment Request (PDF)

Manage your business on the go

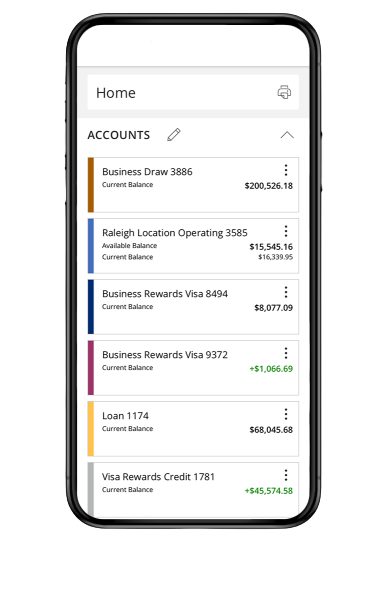

Manage your accounts from anywhere

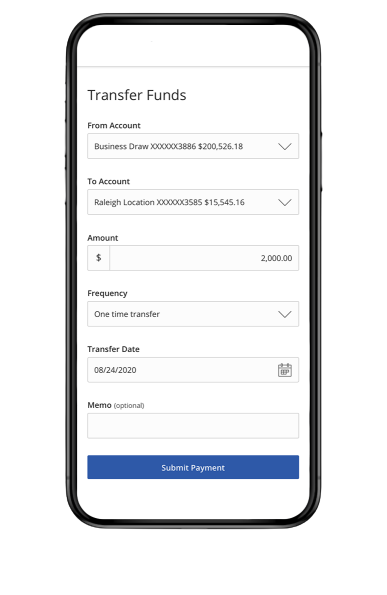

Send and transfer money using ACH and wires

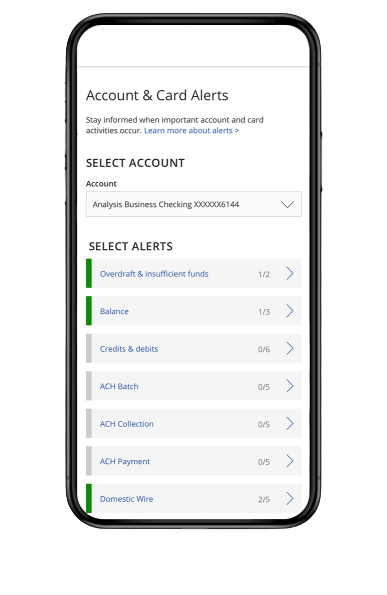

Receive account and security alerts