ACH Payment Services

Process funds quickly and securely with ACH payments

Get ACH payments where they need to go

Make automated clearing house, or ACH, transactions safely and automatically between accounts—so you know exactly where every ACH transfer is going. It's a fast, convenient way to pay employees and vendors.

Flexible

Create single and recurring deposits for ACH payments like payroll, suppliers and taxes.

Reduced costs

Eliminate costs for generating checks, mail and postage.

Simple deposits

Allow customers to make deposits quickly and easily.

Fast and secure

Speed up deposits

Open the door to faster deposits with Same Day ACH payment processing. Same-day clearing and settlement of ACH transactions provides faster funds availability.

Online access

Disburse ACH payments securely online for payroll, reimbursements, tax and other refunds, annuities, and interest payments.

Detailed reporting

Provide detailed reporting for any credit returned or incorrect information that appears in an ACH transaction.

Helpful ACH payment resources

Your ACH questions, answered

Access frequently asked questions and view our interactive Digital Banking for Business User Guide for information on ACH payments and transactions.

National ACH website

Get the latest news, events and education related to ACH payment services at Nacha.org.

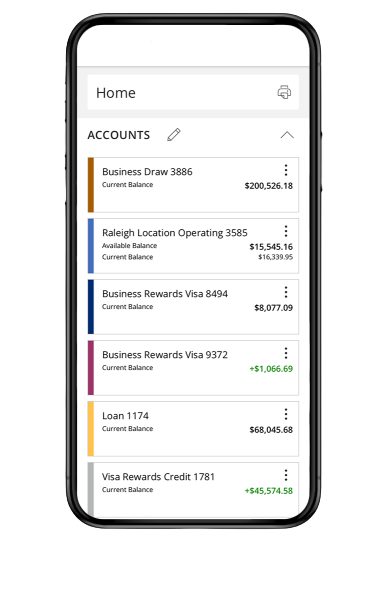

Manage your business on the go

Manage your accounts from anywhere

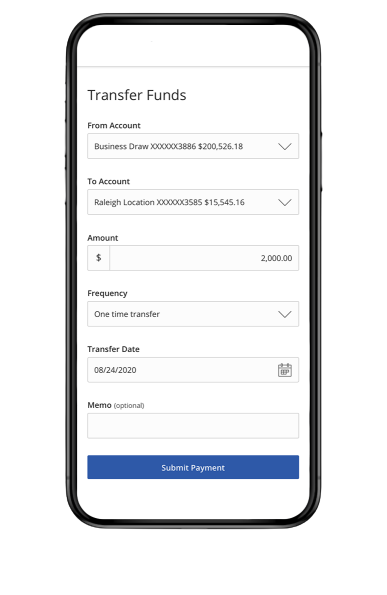

Send and transfer money using ACH and wires

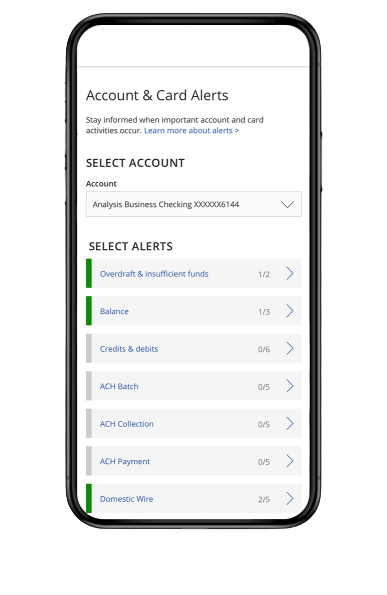

Receive account and security alerts